After exploring CEO pay, the minimum wage debate and the state of American manufacturing jobs over the past several weeks, today, I pose the question: How are American workers faring in this economy?

As outlined last week, although manufacturing employment in America has decreased, American manufacturing output has increased. One of the reasons for this is that American manufacturing companies are employing new technology to become more productive. Indeed, just like it takes Nucor less worker hours to produce a ton of steel and Ford less worker hours to assemble a car, so too does it take Evaero less worker hours to machine a complex aerospace part out of titanium.

So how have increases in efficiency benefitted the average American worker? Ummm…not so well.

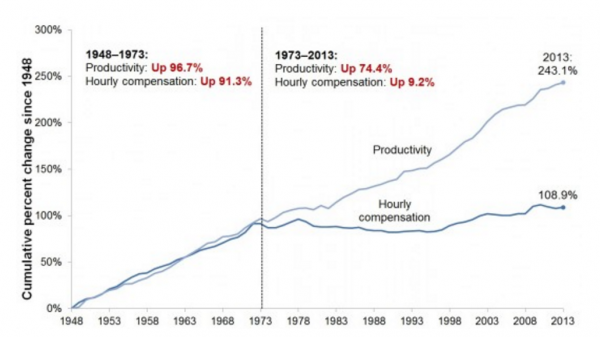

As seen in the Economic Policy Institute (EPI) chart below, in the three decades following World War II, the hourly compensation of American production (nonsupervisory) workers increased as productivity increased¹. Starting in 1973 however, changes in technology, globalization, and union power collectively worked to suppress (median) wages despite increased productivity².

Needless to say, given the historical contributions manufacturing jobs have made to America’s middle class, these data should be worrisome. It’s hard for me to imagine checking or reversing the rise of income inequality in America without addressing the issue of wage stagnation. That said, I have grave concerns about the effect increasing the minimum wage may have on low income families.

So what’s the answer?

My own sense is the U.S. Government should focus on the long term:

Make investments in infrastructure and programs to make America a better place in which to do business

Invest in human capital via vocational and apprenticeship programs, for example.

Get its fiscal house in order

As noted by former chief economist for the International Monetary Fund (IMF), “Overborrowing always ends badly, whether for an individual, a company, or a country.” Eventually, our inability to balance revenue with expenses is going to lead to a very unhappy ending and, when it does, it will be those of us who make a living on Main Street who will end up suffering the most.

Support families

For example, ending the marriage penalty in means-tested welfare programs.

Get “medieval” on the financial sector, to quote Marsellus Wallace.

Consider for example, the financial reform recommendations (none of which involve more regulations) in John Kay’s fantastic book Other People’s Money – The Real Business of Finance (pp. 259-260):

- Re-establish short, simple linear chains of intermediation.

- Restore focused, specialist institutions with direct links to financial users of financial services.

- Require that anyone who handles other people’s money should demonstrate behavior that meets standards of loyalty and prudence in client dealings and avoids conflicts of interest.

- Enforce obligations of high standards of behavior by criminal and civil penalties directed primarily to individuals rather than organizations.

- Treat financial services as an industry like any other.

- Cease using the financial sector as an instrument of economic policy.

A good time to sign out for the week. In a bow to Marsellus, today I’ll leave you with the dance scene from the movie Pulp Fiction.

Cheers…xian

¹ I’m not sure if it matters or not but note that productivity and compensation numbers are typically adjusted for inflation by different means. Also, do note that compensation numbers are for median hourly wages.

² Note however that we all benefit indirectly from increases in productivity because the amount of work time required to buy (most) things has gone down. Indeed, as someone once said, the real cost of living is not measured in dollars and cents but in hours and minutes.

Video not displaying properly? Click here.